business game rules wealth tax【भारत में ऑनलाइन कैसीनो - casino in mumbai ॲप】

Introduction In the rapidly growing world of online entertainment, Indian online casinos have become a popular destination for gaming enthusiasts. Mumbai, being a hub of entertainment and business, hosts several online casinos that attract players from across the country. However, with the rise in wealth generated through these platforms, the concept of wealth tax has become increasingly relevant. This article delves into the business game rules and the implications of wealth tax in Indian online casinos, particularly focusing on Mumbai.

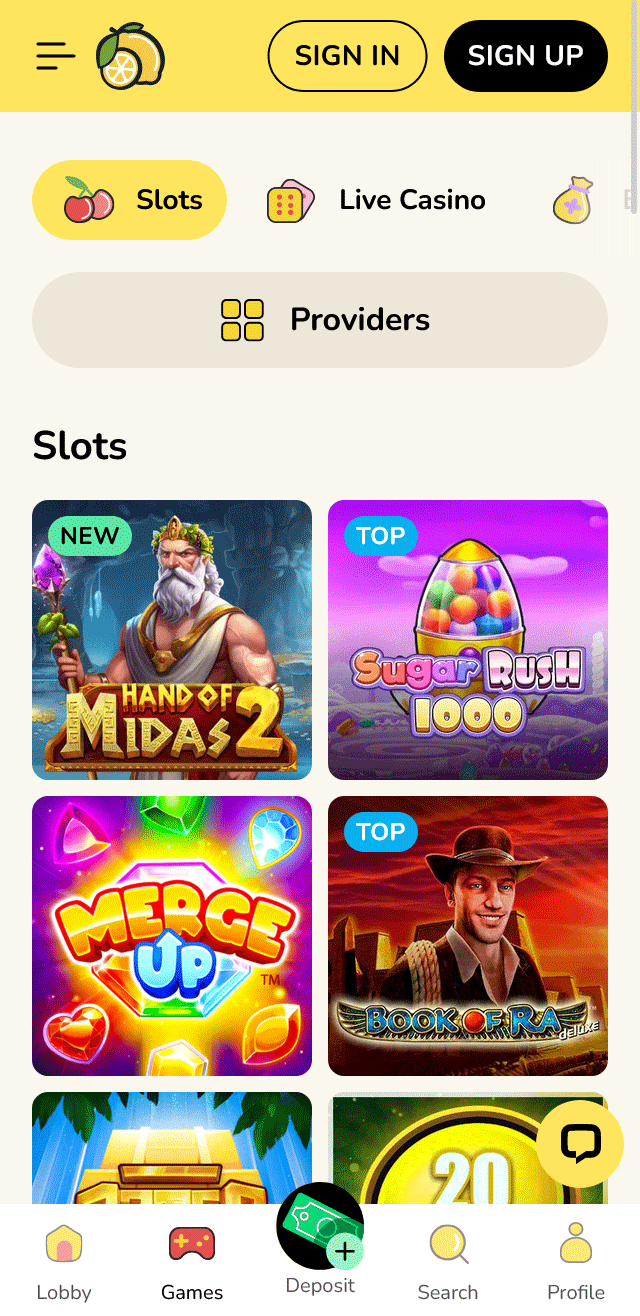

- Starlight Betting LoungeShow more

- Cash King PalaceShow more

- Lucky Ace PalaceShow more

- Silver Fox SlotsShow more

- Spin Palace CasinoShow more

- Golden Spin CasinoShow more

- Lucky Ace CasinoShow more

- Royal Fortune GamingShow more

- Diamond Crown CasinoShow more

- Jackpot HavenShow more

business game rules wealth tax【भारत में ऑनलाइन कैसीनो - casino in mumbai ॲप】

Introduction

In the rapidly growing world of online entertainment, Indian online casinos have become a popular destination for gaming enthusiasts. Mumbai, being a hub of entertainment and business, hosts several online casinos that attract players from across the country. However, with the rise in wealth generated through these platforms, the concept of wealth tax has become increasingly relevant. This article delves into the business game rules and the implications of wealth tax in Indian online casinos, particularly focusing on Mumbai.

Understanding Wealth Tax

What is Wealth Tax?

Wealth tax is a levy imposed on the net wealth of individuals and companies. It is calculated based on the value of assets owned, including real estate, financial investments, and business assets. In the context of online casinos, wealth tax can apply to the profits generated by players and the revenue earned by the casino operators.

Wealth Tax in India

In India, wealth tax was abolished in 2016, but the concept of taxing wealth remains relevant in the form of other taxes such as income tax and capital gains tax. For online casino operators and high-net-worth players, understanding the tax implications is crucial to ensure compliance and avoid legal issues.

Business Game Rules in Indian Online Casinos

Types of Games

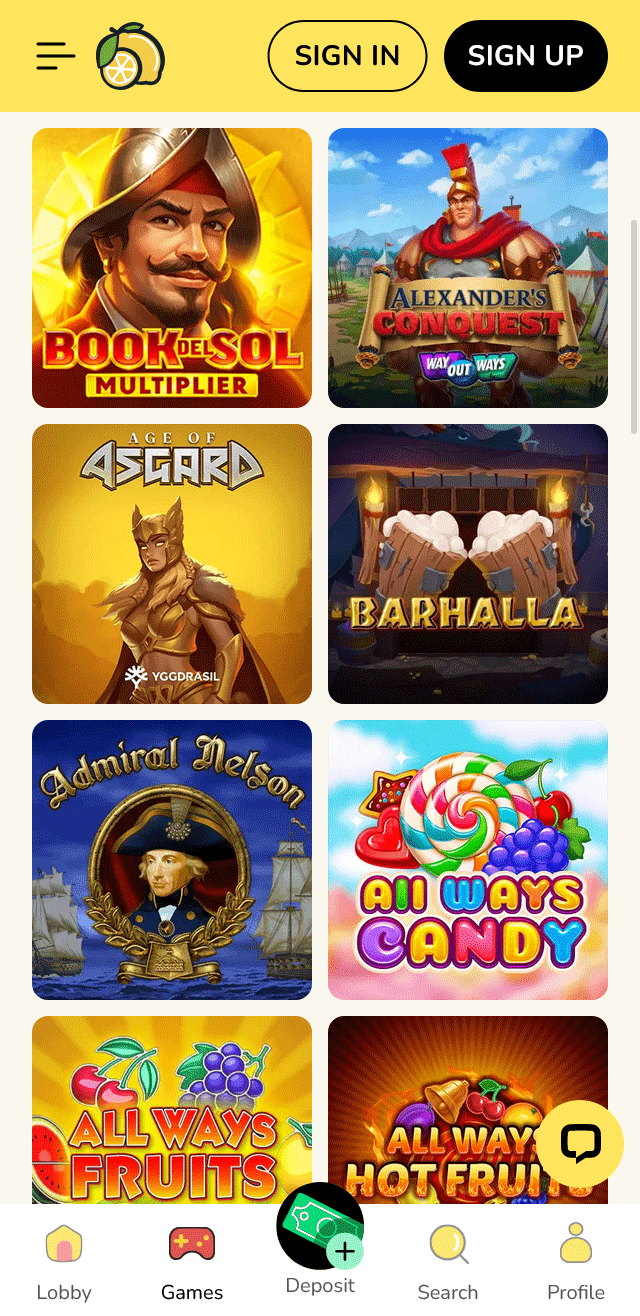

Indian online casinos offer a variety of games, including:

- Baccarat: A card game where players bet on the hand they believe will be closest to nine.

- Electronic Slot Machines: Digital versions of traditional slot machines, offering various themes and payout structures.

- Football Betting: Betting on football matches, including pre-match and live betting options.

- Casino Games: Classic casino games like poker, roulette, and blackjack.

Rules and Regulations

- Age Restriction: Players must be at least 18 years old to participate in online casino games.

- Licensing: Online casinos must be licensed by the relevant authorities to operate legally in India.

- Responsible Gaming: Casinos are required to promote responsible gaming and provide resources for problem gambling.

- Payment Methods: Secure and legal payment methods must be available for deposits and withdrawals.

Wealth Tax Considerations for Players

Reporting Winnings

Players must report their winnings from online casinos as income. This includes:

- Tournament Winnings: Prize money from casino tournaments.

- Jackpot Wins: Large payouts from slot machines or other games.

- Regular Wins: Consistent winnings over time.

Tax Implications

- Income Tax: Winnings are subject to income tax, which varies based on the player’s tax bracket.

- Capital Gains Tax: If winnings are considered capital gains, they may be subject to a different tax rate.

- Deductions: Players can deduct losses from their winnings to reduce taxable income.

Wealth Tax Considerations for Casino Operators

Revenue Reporting

Casino operators must report their revenue accurately to the tax authorities. This includes:

- Gross Revenue: Total income generated from all games and services.

- Operating Costs: Deductions for operational expenses such as salaries, marketing, and technology.

- Profit: Net profit after deducting operating costs from gross revenue.

Tax Compliance

- Income Tax: Operators must pay income tax on their net profit.

- GST: Goods and Services Tax (GST) applies to the services provided by the casino.

- Audit: Regular audits by tax authorities ensure compliance with tax laws.

The business game rules in Indian online casinos, particularly in Mumbai, are governed by a complex interplay of regulations and tax laws. Understanding the implications of wealth tax, both for players and operators, is essential for ensuring legal compliance and maximizing profitability. As the online casino industry continues to grow, staying informed about these rules will be crucial for all stakeholders involved.

deltin royale casino goa ticket price

Are you planning a visit to the Deltin Royale casino in Goa? Located on a majestic vessel, this luxury casino offers an unparalleled experience for gamblers and enthusiasts alike. In this article, we’ll delve into the details of the ticket prices for the Deltin Royale Casino, ensuring that you have all the information needed to plan your trip.

Overview of the Deltin Royale Casino

The Deltin Royale is a luxury casino cruise ship situated in the picturesque Mandovi River, overlooking the stunning beaches and lush greenery of Goa. This 3-decked vessel boasts an expansive gaming area with over 1000 slots and table games, along with luxurious dining options and entertainment facilities.

Ticket Price and Packages

The ticket price for the Deltin Royale Casino varies depending on the package you choose:

- Weekend Pass: ₹999 (₹499 + taxes) - Valid from Friday to Sunday

- Weekday Pass: ₹799 (₹399 + taxes) - Valid from Monday to Thursday

- Day Pass: ₹499 (₹299 + taxes) - Valid for a single day (9 am to 6 pm)

- Night Pass: ₹999 (₹599 + taxes) - Valid for an evening session (7 pm to 3 am)

Additional Charges

- Taxes: 18% GST is applicable on all packages

- Food and Beverage: ₹499 per head for dinner; ₹299 per head for lunch or snack

How to Book a Ticket

To book your ticket, follow these simple steps:

- Visit the official website of Deltin Royale Casino (www.deltin.com)

- Click on “Book Now” and select your preferred package

- Fill in the required details and make the payment online

- Receive a confirmation email with your ticket details

Note: Ticket prices are subject to change, and it’s always best to check the official website for the latest updates.

Other Information

- Timing: The casino operates from 9 am to 3 am daily

- Dress Code: Smart casual attire is recommended; no shorts or flip-flops allowed

- Age Limit: Only individuals above 21 years of age are permitted to enter the casino

By understanding the ticket prices and packages offered by the Deltin Royale Casino, you can plan your visit with confidence. Enjoy an unforgettable experience on this luxurious vessel in Goa!

sports betting in india legal

Sports betting has always been a popular pastime in India, with cricket being the most bet-on sport. However, the legality of sports betting in India is a complex and often confusing topic. This article aims to provide a comprehensive overview of the legal landscape surrounding sports betting in India.

Historical Context

Pre-Independence Era

- British Influence: The British introduced horse racing and betting on it, which became popular in India.

- Legal Framework: Betting was regulated under the British legal system, which continued post-independence.

Post-Independence Era

- 1960s: The government introduced the Public Gambling Act of 1867, which is still in effect.

- 1990s: The rise of online betting platforms began to challenge the existing legal framework.

Current Legal Status

Public Gambling Act of 1867

- Overview: This act is the primary legislation governing gambling in India.

- Key Provisions:

- Penalty for Keeping a Gambling House: Up to ₹200 or imprisonment for up to 3 months.

- Penalty for Visiting a Gambling House: Up to ₹100 or imprisonment for up to 1 month.

- Exemptions: Games of skill are exempt from the act, which has been interpreted to include certain forms of sports betting.

State-Level Regulations

- Varied Laws: Each state in India has the authority to regulate gambling within its jurisdiction.

- Examples:

- Sikkim: Legalized sports betting and operates its own online betting platform.

- Nagaland: Legalized online games of skill, including fantasy sports.

- Goa: Legalized casino gambling and sports betting in licensed premises.

Supreme Court Rulings

1996: Dr. KR Lakshmanan vs. State of Tamil Nadu

- Key Judgment: The court ruled that horse racing and betting on it are games of skill, not gambling, and thus legal.

- Implications: This ruling has been used to argue the legality of other sports betting activities.

2018: Justice K.S. Puttaswamy vs. Union of India

- Key Judgment: The court emphasized the right to privacy, which has implications for online betting and data protection.

- Implications: This ruling has led to discussions on the need for a comprehensive regulatory framework for online betting.

Challenges and Controversies

Taxation

- Income Tax: Betting winnings are considered taxable income.

- GST: There is ongoing debate on whether betting should be subject to Goods and Services Tax (GST).

Social Impact

- Addiction: Concerns about gambling addiction and its impact on society.

- Economic Impact: Potential revenue generation vs. social costs.

Technological Advancements

- Online Betting: The rise of online betting platforms has outpaced the legal framework.

- Blockchain and Cryptocurrencies: New technologies pose additional regulatory challenges.

Future Prospects

Potential Legal Reforms

- Central Legislation: There is a growing call for a central legislation to regulate sports betting uniformly across India.

- Regulatory Bodies: Establishing dedicated regulatory bodies to oversee sports betting activities.

International Comparisons

- UK and Australia: These countries have well-established regulatory frameworks for sports betting.

- Lessons Learned: India could draw from these models to create a balanced and effective regulatory system.

The legal status of sports betting in India is a patchwork of historical laws, state-level regulations, and judicial interpretations. While some forms of sports betting are legal, the industry faces numerous challenges, including taxation, social impact, and technological advancements. Future legal reforms and the establishment of a comprehensive regulatory framework could pave the way for a more organized and regulated sports betting industry in India.

casino club live casino

Overview of Casino Club Live Casino

Casino Club is an online gaming platform that offers a live casino experience to its players. This article provides an in-depth look at the features and benefits of Casino Club’s live casino, as well as other related topics.

What is Casino Club Live Casino?

Casino Club Live Casino is a virtual environment where players can engage with real-time dealers and other players in various casino games such as roulette, blackjack, and baccarat. The platform utilizes advanced technology to provide an immersive experience that simulates the thrill of playing in a physical casino.

Key Features of Casino Club Live Casino

- Live Dealers: Casino Club features professional live dealers who conduct games in real-time, providing an authentic casino experience.

- Multiple Games: A wide range of live casino games are available, including roulette, blackjack, baccarat, and others.

- Interactive Experience: Players can interact with the live dealers and other players through live chat functionality.

Benefits of Playing at Casino Club Live Casino

- Immersive Experience: Casino Club’s live casino provides an immersive experience that simulates playing in a physical casino.

- Convenience: The platform allows players to access their favorite games from anywhere with an internet connection.

- Variety of Games: A wide range of games are available, catering to different player preferences.

How to Get Started at Casino Club Live Casino

To get started, follow these steps:

- Sign up for a free account on the Casino Club website.

- Deposit funds into your account using one of the accepted payment methods.

- Navigate to the live casino section and select your preferred game.

- Place bets and interact with the live dealers.

Additional Topics Related to Casino Club Live Casino

- Responsible Gaming: Casino Club promotes responsible gaming practices, encouraging players to set limits and take breaks when necessary.

- Security: The platform utilizes advanced encryption technology to ensure player data and transactions are secure.

- Customer Support: Casino Club offers 24⁄7 customer support through live chat, email, and phone.

Casino Club Live Casino provides an engaging experience for players looking for a virtual casino environment. With its professional live dealers, variety of games, and interactive features, it’s an ideal platform for those seeking entertainment and excitement. By understanding the benefits and features of Casino Club’s live casino, players can make informed decisions about their gaming preferences.

This article provides an in-depth look at Casino Club Live Casino, covering key features, benefits, and additional topics related to the subject. The information is presented in a clear and concise manner, making it easy for readers to understand and navigate.

Source

- casino epoca online casino

- casino club live casino

- casino club live casino

- casino club live casino

- casino club live casino

- casino club live casino

Frequently Questions

What are the business game rules for wealth tax in India, particularly for online casinos in Mumbai?

In India, the business game rules for wealth tax, including for online casinos in Mumbai, are governed by the Wealth Tax Act of 1957. This act was repealed in 2016, and wealth tax was subsumed under the Income Tax Act. Currently, wealth tax is not applicable, but online casinos must adhere to income tax regulations. Operators must declare their income from online gambling and pay taxes accordingly. Additionally, they must comply with local regulations and obtain necessary licenses. For precise details, consulting a tax expert or referring to the latest Income Tax Act provisions is advisable.

Is It Possible to Become a Millionaire with the Help of a Casino-Playing Entrepreneur in Bangalore?

Becoming a millionaire through casino-playing with an entrepreneur in Bangalore is highly improbable. While gambling can yield short-term gains, it is predominantly a game of chance with long-term negative expected value. Reliance on luck rather than skill makes it a risky strategy for wealth accumulation. Instead, consider sustainable financial strategies like investing in education, starting a business, or investing in the stock market. These methods offer more reliable paths to financial success. Remember, the house always has an edge in casinos, making consistent winnings unlikely. Focus on building a solid financial foundation through prudent, long-term investments.

How can I participate in a casino prife competition?

Participating in a casino prize competition involves several steps. First, ensure you meet the eligibility criteria, which typically include age and residency requirements. Next, register for the competition by providing necessary personal information and possibly creating an account. Familiarize yourself with the competition rules, including game types and wagering requirements. Engage actively by playing the specified games and accumulating points or meeting specific milestones. Stay updated with competition announcements and leaderboard standings. Finally, if you win, follow the instructions for claiming your prize, which may involve verification and tax documentation. Always gamble responsibly.

How does a Bangalore entrepreneur assist people in achieving millionaire status by playing casinos?

A Bangalore entrepreneur can assist people in achieving millionaire status by playing casinos through strategic guidance and financial management. This involves teaching risk management, understanding odds, and leveraging bonuses and promotions. By focusing on disciplined betting and smart bankroll management, individuals can maximize their chances of winning. Additionally, staying informed about casino rules and game strategies can enhance their edge. However, it's crucial to approach casino gaming as a form of entertainment with controlled financial risks, rather than a guaranteed path to wealth.

How do wealth tax rules apply to business games in India, especially for online casinos in Mumbai?

In India, wealth tax rules apply to business games, including online casinos in Mumbai, by assessing the net wealth of individuals and businesses. The Wealth Tax Act of 1957 imposes a tax on the net wealth exceeding a specified threshold. For online casinos, this involves calculating the value of assets, including business holdings, less allowable deductions. Mumbai, being a financial hub, ensures strict compliance with these regulations. Operators must maintain accurate records and file timely returns to avoid penalties. Understanding these rules is crucial for legal operations and financial planning in the gaming industry.